Benton County voters will soon have opportunity to approve a proposal for construction of a long-awaited and desperately-needed new jail, or to reject it for a second time, keeping the status quo which for health, safety and security reasons is unacceptable.

The 162-year old building has been the subject of articles and conversations for the past several years. See https://readmyquips.wordpress.com/2014/11/) and search the print edition of the Benton County Enterprise for more information.

Photos by J.E. Coates

Photos by J.E. Coates

County Commissioners approved a motion on January 22, 2018 to place Proposition 1 on the April 2018 municipal election ballot.

Shall the County of Benton, Missouri impose a county wide sales tax in the amount of one-half of one percent ($0.005) for a period of twenty-one years from the date on which such tax is first imposed for purposes of operations and paying for construction of a new jail for detention facilities and administrative office space for the County Sheriff’s operations? If approved, this sales tax will expire on September 30, 2039 or whenever the final payment occurs on lease certificates of participation financing, whichever comes first.

If approved, after solicitation and acceptance of construction bids, the project, estimated to take 2-1/2 years to complete, would begin in Spring 2019.

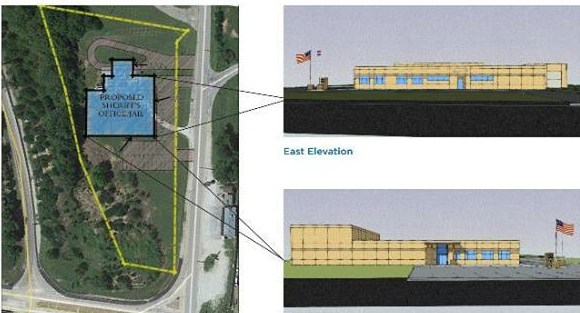

The proposed site is on the access road across from the former Smoke Shack BBQ. It is close to the ambulance center, close to the water tower, has sewer and utility lines in place – saving an additional $1-2 million, and gives easy access to Hwy 65.

Sheriff Knox said the jail is “designed specifically for Benton County, based on information pulled from the jail project archives, and is exactly what the people asked for. The new plan saves nearly $5 million. Much of the space is multifunctional, and unlike now, it is extremely secure.”

The design is state of the art, Knox said. There are no razor wires. Inmates will be brought in via a secured sally port and will not be outside unless they have been released by the proper authorities and procedures. No homes or children’s school or play areas are in the immediate vicinity; the jail will not be in anyone’s backyard.

Knox said everyone involved in the jail project has taken seriously the responsibility to be good stewards of taxpayer money. Geographically, site selection was limited because of the lakes, and because of the goal to save between $1-2 million by locating options with water, sewer and electricity already available. The difference between the site selected and the next best location about 100 yards south of it, was the price.

He respects opinions of residents who are protesting the location, Knox said. He believes they do not yet have all the facts. Distribution of information about the jail project has begun, and opportunities to ask questions and learn more about the details will be available soon through townhall meetings.

On February 1st the sheriff posted a photo of the conceptual design on his Facebook page: https://facebook.com/SheriffKnox/ where more than 45 comments and 79 shares are supportive of the plan to date.